Essex Global Environmental Opportunities Strategy (GEOS)

Third Quarter ended September 30, 2024

With the US Presidential election approaching, it seems everything has been politicized today, including most facets of the energy transition. Yet we believe any political risk for the clean tech sector is overly discounted at present, expediting attractive valuations and growth prospects. Beyond this exaggerated political overhang, we believe many of the significant headwinds buffeting the clean tech sector are dissipating. This has been reflected in the positive returns for our Strategy this quarter. Clean tech company fundamentals are improving, valuations are attractive and the economic backdrop remains healthy.

During the third quarter of 2024 ending September 30, the Essex Global Environmental Opportunities Strategy (GEOS) returned 7.61% (7.35% net), outperforming the 6.02% return for the MSCI World Index without income (Index). The Wilderhill Clean Energy Index posted -0.20% for the third quarter. For the year-to-date ending September 30, GEOS returned 10.43% (9.61% net) versus 17.48% for the MSCI Index and -32.09% for the Wilderhill. We believe the clean tech sector is highly inefficient. GEOS outperformance versus the Wilderhill is due to our consistent investment process and execution, investing in commercially-viable companies offering true solutions to environmental problems. Strategy outperformance versus the primary Index should continue as market and fundamental catalysts continue to unfold.

Performance for the third quarter was led by GE Vernova (ticker GEV), the diversified power technology company focused on ten markets, from steam heat to wind, grid solutions and nuclear. The electrification business which includes Grid Solutions is the fastest growing segment currently as measured by bookings and billings. MP Materials (MP) was a top performer, as the market finally recognizes the huge differentiation of this domestic producer of critical rare earth materials. China controls most of the global rare earth content, and MP is the leader for US rare earth mining, separation and refining. MP’s resource in Mountain Pass California is one of the lowest cost resources in the world, and the company is expanding downstream into high-powered magnet production at a new plant in Texas with an initial offtake arrangement with GM. Long-standing water holding Energy Recovery (ERII) posted strong returns, as the leading energy efficiency provider for desalination plants announced new orders in the Middle East, along with improving margins given pricing discipline under the tutelage of new CEO David Moon. Underperformance for the quarter was led by advanced driver assistance systems (ADAS) company Mobileye (MBLY), which suffered from a buildup of field inventory. The position was sold in August given our concerns over market share loss to cheaper technologies. Battery technology company Enovix (ENVX) was a laggard as the silicon anode firm scaled its manufacturing plant in Malaysia. Array Technologies (ARRY) continued to underperform, given pushouts in large scale solar projects due to permitting delays and in some cases lack of inventory for critical inputs such as transformers.

We added a new position in the GEOS water theme, Advanced Drainage Systems (WMS), which is primarily positioned to benefit from climate change adaptation efforts. WMS is focused on water management solutions including water quality, drainage, basin management and stormwater management. WMS offers services to improve flood security, recharge aquifers and mitigate the risk of water scarcity. The source of funds for this new position was the sale of Zurn Elkay Water Solutions as it hit our valuation target.

As we stated at the outset, a recovery for clean technology stocks is unfolding, based on improving fundamentals within the sector as well as the economy. Management teams generally have more favorable outlooks on their businesses. Some industries which experienced excessive inventory levels are seeing these inventories return to norm, such as Generac Holdings, whose dealer network double-ordered after Covid to ensure they had generators on hand, limiting sales growth for the past 16 months. Generac now has better channel and shipping visibility, leading to improved growth and guidance. The high-interest rate environment and tight labor market that has been causing large infrastructure project pushouts is also abating. Energy Recovery is seeing an improvement in desalination mega-projects in the Middle East, leading to improved earnings visibility for the back half of this year. Aspen Aerogels is held in the GEOS efficient transport theme, because the company offers an economically viable fire-suppression technology for EV batteries. Despite alarmist headlines, the global EV transition is not only intact, but growing, leading to Aspen beating second quarter estimates on earnings, revenues and profits. Aspen has an offtake agreement with GM who just announced at this writing reconfiguration of its EV technology to allow more product development nimbleness to compete with EV global dominator China.

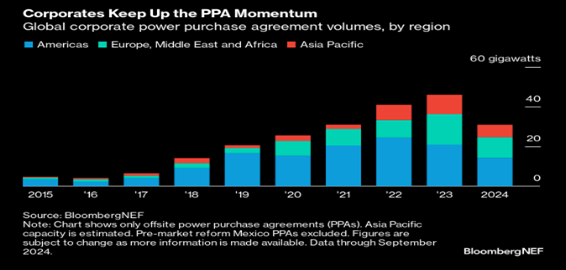

As we have stated before, energy enables everything – from economic growth to social wellbeing. The clean tech transition enables electrons derived from distributed sources to replace fossil fuel molecules, most of which is wasted. According to a recent report from the Lawrence Livermore National Labs, over 2/3 of all energy produced in the US is waste heat, such as the warm exhaust that is released from furnaces or cars. This ancient heating method is wasteful, and not scalable. Corporations are increasingly aware of this, and are turning to renewable energy to power operations while lessening risk, from commodity to operational per this chart:

The clean tech revolution is ever expanding and will play an even more important role if the trend to more onshoring of our industrial economy is to take place, which will be complicated by increased data center development. Each of the nine GEOS themes enables doing more with less, with the power technology theme we have been emphasizing for several years paramount. We strongly recommend going beyond headlines and looking at the trends at hand – long-term growth trends enabled by commercially viable clean technologies that are enabling economic growth including job creation across our country – in all districts. We believe the companies offering these technologies and services will have growth and profitability that will be reflected in their share prices as the clean technology recovery continues to unfold.

Disclosures:

This commentary is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. The opinions and analyses expressed in this commentary are based on Essex Investment Management LLC’s (“Essex”) research and professional experience and are expressed as of the date of its release. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is intended to speak to any future periods. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties.

This does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product, nor does it constitute a recommendation to invest in any particular security. An investment in securities is speculative and involves a high degree of risk and could result in the loss of all or a substantial portion of the amount invested. There can be no assurance that the strategy described herein will meet its objectives generally or avoid losses. Essex makes no warranty or representation, expressed or implied; nor does Essex accept any liability, with respect to the information and data set forth herein, and Essex specifically disclaims any duty to update any of the information and data contained in the commentary. This information and data does not constitute legal, tax, account, investment or other professional advice. Essex being registered by the SEC does not imply a certain level of skill or training.

Please find important disclosures here