Essex Global Environmental Opportunities Strategy (GEOS)

First Quarter ended March 31, 2025

There are multitudes of platitudes from finance professionals and academics regarding the importance of discipline during periods of stock market volatility. At this writing, the global capital markets are experiencing extreme volatility given US tariff actions and the anticipated repercussions. While the Mag 7 sells-off after leading the equity market for two years, clean tech stocks are selling off after lagging the market for several years. Platitudes aside, despite the continued weakness of the clean technology sector, we are observing generational opportunity across our Essex Global Environmental Opportunities Strategy (GEOS). Our heightened confidence amidst this market turmoil is based on the following key observations and assessments:

- Clean technology continues to grow globally

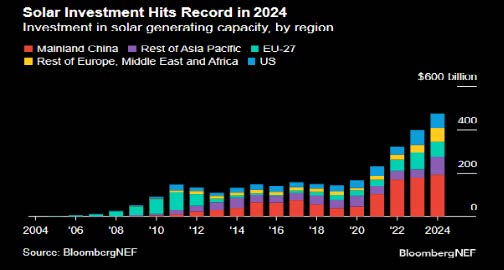

The past several years have brought massive commercial adoption of clean technologies across global economies, as rapidly declining costs and increased efficiencies of industries such as solar power usurp market share from incumbent technologies. The solar revolution is led by China, given globally leading government support and incentives, illustrated in the red portion of the stacked bar charts below:

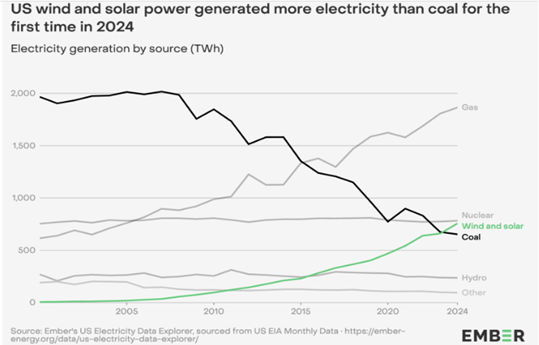

China enabled low-cost solar modules, continuing a buying frenzy last year of clean energy by the likes of Amazon, Meta, and Google, setting records for corporate renewable power purchase agreements (PPAs) of over 62 gigawatts, up 36% from the previous record set in 2023 (source: Bloomberg New Energy Finance – BNEF). It is due to cost and efficiency of deployment that solar and wind power generated more power than coal for the first time in 2024, illustrated on the top of the next page.

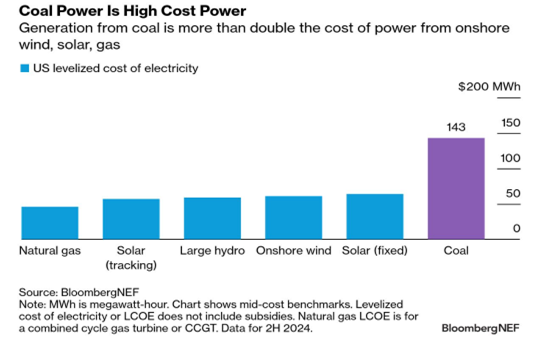

At this point in the US power transition, we believe solar power will continue its growth trajectory as the solar supply chain is resilient with the ability to meet installation demand for the next 24 months we project as companies have been tactically planning for potential policy shifts, such as a more rapid sunsetting of tax incentives, with appropriate supply chain inventory management. We interpret messaging from the Administration regarding energy policy as an “all of the above” solution, yet one based on rational economics, not antiquated will such as bringing back coal power as it is too high cost:

GEOS has exposure to solar, wind, nuclear and natural gas turbines with current holdings such as GE Vernova, First Solar and NextEra Energy – some of our highest conviction positions.

Water is a theme we see as well positioned, as water utilities are increasingly investing in technologies to manage water, from data management in the throes of forthcoming regulations for PFAS, to water management amidst increased variability of precipitation and water stores. Desalination is a technology that is mature in the Middle East, yet there are finally some green shoots here in the US with proposed projects in Texas. Water is directly attributed to social welfare and economic growth and currently exhibited as a direct input for power generation and data center management. There are several water holdings in GEOS, from Energy Recovery, to Veralto, Badger Meter, Valmont and Advanced Drainage Systems.

EVs have been in the political cross hairs here in the US, yet the trend toward vehicle electrification is fully intact despite the rhetoric, with EV sales up globally 92% year over year as of March 31, led by China (source: BNEF). 20% of global vehicle sales last year were EVs according to BNEF, yet in China the EV mix was 46%. Global EV growth will continue this year and may even accelerate given the tariff picture, as gas vehicles have much more cross border supply chain movements than electric vehicles, which will bring EVs even closer to price parity with internal combustion (ICE) vehicles. While we do see US EV tax incentives at risk, GEOS holds China-based BYD, which has now surpassed Tesla in global EV sales, as well as Rivian Automotive, which has all its current and planned manufacturing based in the US. We could provide many other examples of commercially viable clean technology progress but suffice to say current clean tech growth is in no way reflected in market sentiment lately. Importantly, clean technology is commercially viable and taking market share given lower costs and business risks.

- Commercially viable clean tech companies offer profitable unrecognized growth

Attractive clean technology businesses offer revenue growth, with management teams striving for profitability and positive free cash flows. These CEOs, CFOs and their teams are focused on positive returns on capital and increased shareholder equity. Financial goals are attained with a focus on commercial viability and prudent business strategy and execution to fund growth efficiently with an eye to limit shareholder dilution. Commercial viability for investible clean technologies is key, coupled with the growth trajectories of companies achieving commercial adoption in their targeted markets. We further define commercial viability as a technology or service that achieves adoption in the absence of any government policy or incentive structure.

As the ample liquidity of the pandemic eroded the past few years, companies offering non-commercial technologies and services have seen increased capital costs causing high cash burn rates, and unsustainable, negative financial returns. We have witnessed this both across established industries such as segments of solar, as well as deeply within industries that have yet to achieve overall commercial adoption, such as hydrogen vehicles. As we have oft repeated, GEOS does not invest in lab experiments. Our investment criteria is centered on positive returns on capital and positive free cash flow generation, which are exhibited with commercial viability.

GEOS consists of companies which are primarily in mature industries, but benefit from pockets of accelerating growth, offering solutions that enable efficiency and cost savings for their customers:

Deere, a new position for GEOS added in February, enables greater farm efficiency with connected farm technologies, to optimize inputs such as fertilizer and seed usage while achieving more insights on conditions such as soil salinity. We believe Deere is in an emerging recovery in the agriculture cycle and can expand EBITDA margins beyond 18%.

Veralto offers water management and purification solutions to industry and water utilities, with over 24% EBITDA margins.

Hubbell makes electrical grid components from harnesses to substation components, and exhibits stable EBITDA margins of 24%+, with consistent free cash flow.

- There is generational opportunity at hand

The clean tech stock underperformance of the past several years presents a strong, generational opportunity for patient, long-term investors. Many non-commercial businesses in the clean tech sector came to market too early, or with poor models that could not scale. Yet, we see valuations across the sector and across our universe that do not differentiate the commercial – the profitable from the non-commercial. Broadly, valuations are at parity, reflecting poor sentiment, with stock prices that are responding to headline risk with “shoot first and ask questions later.” For example, Canadian Solar (not owned) is an Ontario based solar module manufacturer and project developer. The company has a 1.0% return on equity with flat EBITDA margins and a 34 times forward P/E in a commodity industry that has significant tariff risk as they export out of China and APAC. First Solar, held in the GEOS renewable energy theme has an 18.0% return on equity with 39% EBITDA margins and a 9 times forward P/E with a US-centric manufacturing model which is booked out 36 months with limited tariff risk. We see opportunity here with First Solar and added to our position twice over the quarter on continued share price weakness. Another example is Plug Power (not owned), which offers hydrogen powered materials handling equipment for warehouses, and has been a consistent destroyer of shareholder capital, with highly negative returns on capital and cash burn of over $500 million last year. Contrast that with GEOS holding Kion, providing materials handling and automation technologies with 16% EBITDA margins and solid cash flow with an 11 times forward P/E. The opportunities at hand reflect opportunities across our themes, and we do believe differentiated fundamentals will be recognized.

The market has sold off clean tech since the election simply based on headlines reflecting the threats of full roll backs of the Inflations Reduction Act (IRA) by the Administration, leaving the valuations referenced above. Clean energy corrected after the announcement of the IRA back in 2022, and we believe a full repeal of the IRA is unlikely, yet fully priced into the sector currently. Yes, the market can be irrational, but please consider our consistent points of view regarding the clean tech sector, and our approach with GEOS:

-diversification across nine themes, all enabling “doing more with less”

-commercial viability – no lab experiments, profitable businesses not dependent on subsidies

-focus on free cash flow, shareholder equity and returns on capital.

This, in addition to the many drivers of our GEOS holdings for driving productivity and power for US and global economic growth.

Quarterly Performance and Summary

During the first quarter of 2025 ending March 31, the Essex Global Environmental Opportunities Strategy (GEOS) returned -7.44% (-7.68% net), versus -2.14% for the MSCI World Index without income (Index). The Wilderhill Clean Energy Index[1] posted -21.62% for the first quarter. Please note we believe our outperformance versus the Wilderhill exemplifies our focus on commercially viable, profitable companies across our nine GEOS themes.

During times of heightened market volatility and negative sentiment, we hone in on our investment process, revisiting the key drivers for our GEOS holdings, current valuations, growth estimates, and risk assessments. Our transactions over the first quarter reflect this tactic, with the sale of Cadeler driven by increased risks of offshore wind development, or trimming Primoris Services after strong performance earlier in the quarter. This tactical focus keeps us balanced amidst extreme market volatility. While we concur that there has been negative sentiment directed at the clean technology sector, we believe that our GEOS holdings reflect overly fair valuations when factoring the potential for future growth of cash flows and earnings per share. We believe that companies solving environmental problems are viable businesses, now as much as before.

Disclosures:

This commentary is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. The opinions and analyses expressed in this commentary are based on Essex Investment Management LLC’s (“Essex”) research and professional experience and are expressed as of the date of its release. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is intended to speak to any future periods. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties.

This does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product, nor does it constitute a recommendation to invest in any particular security. An investment in securities is speculative and involves a high degree of risk and could result in the loss of all or a substantial portion of the amount invested. There can be no assurance that the strategy described herein will meet its objectives generally or avoid losses. Essex makes no warranty or representation, expressed or implied; nor does Essex accept any liability, with respect to the information and data set forth herein, and Essex specifically disclaims any duty to update any of the information and data contained in the commentary. This information and data does not constitute legal, tax, account, investment or other professional advice. Essex being registered by the SEC does not imply a certain level of skill or training.

[1] The Wilderhill Clean Energy Index (ticker: ECO) is a modified equal dollar weighted index comprised of publicly traded companies whose businesses stand to benefit from societal transition toward the use of cleaner energy and conservation.

Please find important disclosures here