The Call for Clean Tech Optimism

Skepticism and pessimism aren’t synonymous. Skepticism calls for pessimism when optimism is excessive. But it also calls for optimism when pessimism is excessive.

– Howard Marks, The Limits to Negativism, October 15, 2008

While the broader market continues to reach new highs, clean tech stocks remain deeply out of favor. Through April 30, 2024, the WilderHill Clean Energy Index had a one-year total return of -42.7%, lagging the broader market as measured by the MSCI World Index which had a total return of about 19% for the same 12-month period. In hindsight, it is relatively easy to point to a number of reasons that have presented headwinds for clean tech companies:

- Rising interest rates

- Inflationary cost pressures

- Near term slow-down in electric vehicle sales and renewable power installations

- Too many “zombie” and immature clean tech companies following the Special Purpose Acquisition Company (SPAC) boom

- Slow rollout of key facets and funding of the Inflation Reduction Act

- Politicization of clean tech and peripheral impact of ESG investing backlash

While our clean tech strategy, Essex’s Global Environmental Opportunities Strategy (“GEOS”), substantially outperformed the WilderHill Clean Energy Index over the past year, it still lagged the MSCI World Index leading prospective investors to question whether an investment in a clean tech thematic fund ever is appropriate. Indeed, we have asked ourselves the existential question of why we are still committed to this effort. The pessimism is pervasive.

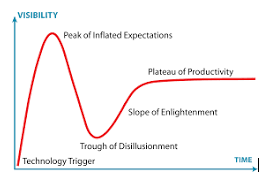

Amara’s law posits that we tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run. Pockets of clean tech currently seem to be suffering from stock market disappointment following promising growth and excitement a few years ago. Notable examples of this would be electric vehicles, energy storage and offshore wind power. Many overestimated the growth of these technologies in the short term. In the Gartner Technology Hype Cycle we are planted firmly in the Trough of Disillusionment; we believe the ensuing Slope of Enlightenment phase of the cycle is not far ahead.

Source: Gartner

In our view, the pervasive clean tech pessimism is opportunity.

We have personally witnessed periods over the past 25 years where certain sectors or cohorts of stocks have fallen deeply out of favor and have been abandoned by most market participants. The current sentiment around clean tech stocks today is reminiscent of the traditional energy sector in 2020. By the end of 2020, the S&P 500 Energy Index was the worst performing sector over the prior decade. It was the absolute worst performing sector for five of the prior ten years and was the second worst performing sector for an additional two years during that period. In 2012, the Energy sector accounted for more than 12% of the total weight of the S&P 500 Index but by the end of 2020 it had fallen to less than 3% of the weight of the broad index. The sector was loathed and under owned, ironically for many of the same reasons that clean tech is shunned today: poor historical returns, lack of profitability, volatility of results, bankruptcy of poorly capitalized companies. Since the end of 2020, the Energy sector has been the best performing sector in the S&P 500 Index through March 31, 2024 (yes, the Energy sector has even outperformed the Tech sector since the end of 2020). To paraphrase Howard Marks, optimism is called for when pessimism is excessive. We believe we are at this point in clean tech.

We see encouraging signs of recovery emerging in our clean tech universe. For example, with the market’s seemingly singular focus on artificial intelligence, sell-side and buy-side analysts alike seeking AI-related plays are realizing that our strained and outdated electrical grid is a potential bottleneck to growth. The GEOS team has been discussing, analyzing and investing in energy efficiency, power technology, power generation and grid stabilization technologies for several years now. Elsewhere in our portfolio, we see increasing demand for clean water and greater implementation of factory automation solutions being driven by onshoring of manufacturing and the need to control costs given inflationary costs. These are but a few examples of the strong underlying secular growth trends underpinning the clean tech opportunity.

Clean tech pessimism is pervasive and unquestioned. As Howard Marks opined further in another of his memos: “That doesn’t mean that it can’t decline further, or that a bull market’s about to start. But it does mean that the negatives are on the table, optimism is thoroughly lacking, and the greater long-term risk probably lies in not investing.” From the technologies that we assess and the companies that we meet with and invest in, we strongly believe that the market is underestimating the clean tech investment opportunity at hand.

Disclosures:

This commentary is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. The opinions and analyses expressed in this commentary are based on Essex Investment Management LLC’s (“Essex”) research and professional experience and are expressed as of the date of its release. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is intended to speak to any future periods. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties.

This does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product, nor does it constitute a recommendation to invest in any particular security. An investment in securities is speculative and involves a high degree of risk and could result in the loss of all or a substantial portion of the amount invested. There can be no assurance that the strategy described herein will meet its objectives generally or avoid losses. Essex makes no warranty or representation, expressed or implied; nor does Essex accept any liability, with respect to the information and data set forth herein, and Essex specifically disclaims any duty to update any of the information and data contained in the commentary. This information and data does not constitute legal, tax, account, investment or other professional advice. Essex being registered by the SEC does not imply a certain level of skill or training.

Please find important disclosures here.