Small Cap Stocks Provide Opportunities During Election Years

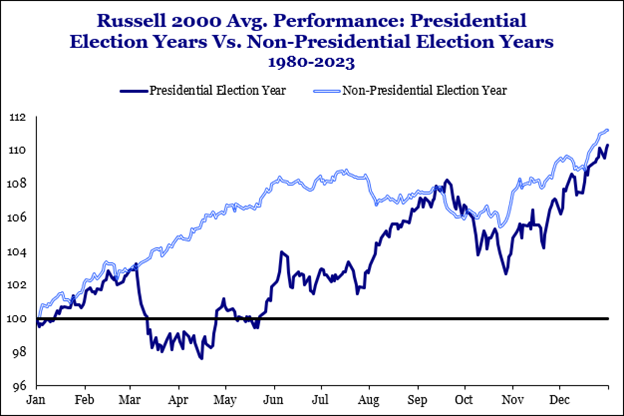

Every four years, investors wonder what the potential impacts of both the election cycle and the subsequent election results might be. Small cap stocks, as well as other asset classes, can exhibit unique performance patterns during election years, influenced by the political and economic uncertainty that often surrounds these periods. September, in particular, has been called “the cruelest month” and in fact has declined an average of 1.2% that month going back to 1928 (per the Wall Street Journal). However, during election years, October has been even more challenging for the S & P 500 with a decline, on average, of 1.4% since 1980 (per the Wall Street Journal). This negative short-term trend is a result of the uncertainty stemming from the unknown outcomes of the election cycle. Here are some considerations for navigating election cycles:

- Increased Volatility:

- Uncertainty: Election years typically bring uncertainty, as markets try to anticipate the potential policies of the next administration. This can lead to increased volatility, and small-cap stocks, which are generally more volatile than large-cap stocks, may experience more significant swings.

Source: Strategas

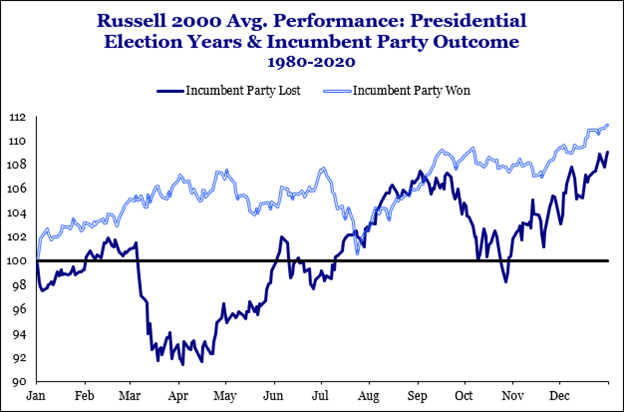

On average, this increased volatility and September/October weakness has provided a buying opportunity as small cap stocks have had a strong recovery post-election. In fact, this pattern has held whether or not the incumbent party is the ultimate victor in the election.

Source: Strategas

Source: Strategas

- Historical Trends:

- Election Year Outperformance: Historically, small-cap stocks have often performed well during election years, despite the increased level of volatility leading immediately up to the election.

Source: Strategas

Source: Strategas

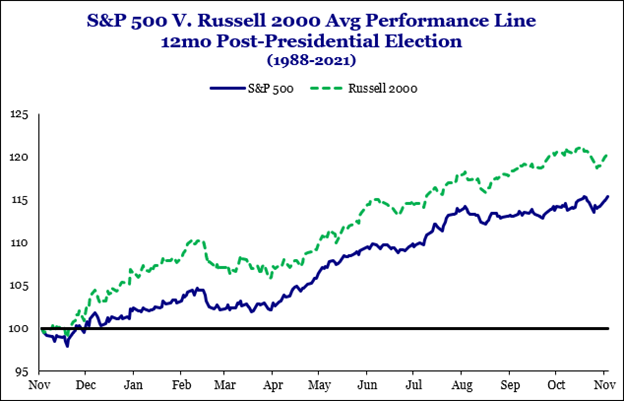

After the election, once the uncertainty is resolved, small-cap stocks generally experience a strong rally and have not only demonstrated strong absolute performance but also strong relative performance compared to large cap stocks

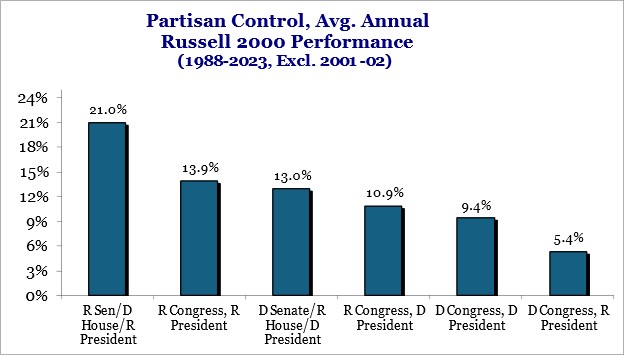

- Presidential Party versus Congress Impact:

- Market Likes Split Government: Although all scenarios are positive for performance, the market clearly likes the concept of some level of fiscal control , as evidenced by the performance advantage with a Republican Senate, House, or both. However, these data indicate that positive returns for small cap stocks occur in all scenarios. In fact, the evidence shows that split governments do not matter as much as people think.

Source: Strategas

Source: Strategas

In summary, small-cap stocks during election years are influenced by uncertainty, potential policy changes, and market sentiment. While they can experience increased volatility, they also have the potential for strong performance, particularly if the political environment and economic policies are seen as favorable to their growth prospects. These patterns of performance provide an opportunity for investors to exploit this short-term volatility by leaning into it and benefit from the subsequent post-election market action.

Disclosures:

This commentary is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. The opinions and analyses expressed in this commentary are based on Essex Investment Management LLC’s (“Essex”) research and professional experience and are expressed as of the date of its release. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is intended to speak to any future periods. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties.

This does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product, nor does it constitute a recommendation to invest in any particular security. An investment in securities is speculative and involves a high degree of risk and could result in the loss of all or a substantial portion of the amount invested. There can be no assurance that the strategy described herein will meet its objectives generally or avoid losses. Essex makes no warranty or representation, expressed or implied; nor does Essex accept any liability, with respect to the information and data set forth herein, and Essex specifically disclaims any duty to update any of the information and data contained in the commentary. This information and data does not constitute legal, tax, account, investment or other professional advice. Essex being registered by the SEC does not imply a certain level of skill or training.

Please find important disclosures here.