GEOS Insights: The Scream

March 18, 2025

While our inclusion of Edvard Munch’s ‘The Scream’ could be an apt symbol for recent market volatility, the painting is more apropos for our assessments of recent power and electric utility conferences. Data centers and their utilities are screaming for more power. Now. And pricing is irrelevant – power demand from the commercial and industrial sector, primarily data centers is price inelastic currently, and could well remain so for several years. This, after the DeepSeek Sputnik scare a few weeks back, when the market overreacted to a new large language model from the Chinese upstart, which, at first blush was rendered more efficient with processing power – and later disproven in a MIT study. The important take home post several power and renewable conferences is our conviction exhibited by the GEOS power technology theme is warranted, and we believe currently underappreciated by the market after the recent market sell-off.

Today, power markets are tight, driven by surging demand from data centers as electric utilities strive to control increased loads while operating under the added pressures of weather events, labor shortages and strained inputs such as raw materials and transformers. To boot, utility grid investments have been inadequate in most regulated and deregulated markets the past twenty years, resulting in surging power costs. Projections are all over the map on how much power demand will increase the next decade, but we know the increase will be significant. After growing at rates less than that of GDP growth over the past two decades, we believe power demand given concurrent drivers will be at least 4% annualized going forward, and ours is a conservative estimate. Some estimates are as high as 12% annualized growth in domestic power demand. The concurrent drivers are numerous, ranging from increased nationalism driving prospects for onshore industrial development to the cry for data center dominance as a point of global economic and geopolitical differentiation.

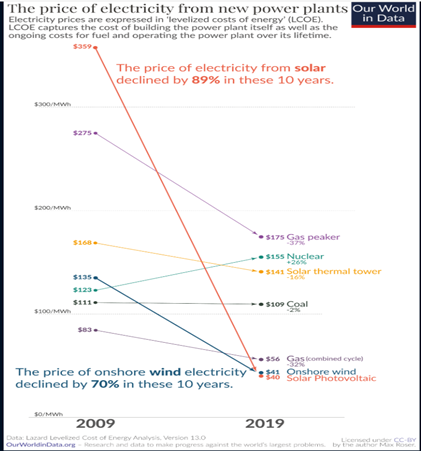

Electrification is the modern way forward, and renewables are the only economic solution currently. Just last week, NextEra Energy (current GEOS portfolio holding) CEO John Ketchum stated at CERAWeek that gas fired generation will only be able to meet 16% of domestic energy demand in 2030, given severe equipment supply constraints and a significant increase in the cost of gas turbines over the past few years. Ketchum’s projection has credibility, as NextEra executes an “all of the above” energy development strategy, from gas-fired generation to onshore wind, and solar as well as battery storage and nuclear. To get those British thermal units of energy to power our economy (GDP=BTU), solar+storage is the most economic and the only option that is immediately available. Further, the more we install, the more economic security we have. The benefits start with cost, and end with the dispatchable installation model. For this reason recent orders from data centers have been so-called behind the meter installations.

The major take home of the past week of conferences is solar is a critical source of power for our country’s growing power needs, and will continue to be the leading alternative moving forward, despite the political rhetoric and risks of incentive rollbacks, which we and others negate given the above chart from Our World in Data. Solar is too disruptive and will be complemented by battery storage as well as natural gas peaker and baseload the next decade. GEOS has broad direct and indirect exposure to the trend to modern electrification across the power ecosystem, including electrical grid construction, equipment production, grid monitoring and enhancing, and utility scale solar development. As we assess the current geopolitical, economic, and capital markets states, we believe this trend to be underappreciated with strong and long-tailed fundamentals well intact.

For more information, please visit us at www.essexinvest.com

Disclosures:

This commentary is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. The opinions and analyses expressed in this commentary are based on Essex Investment Management LLC’s (“Essex”) research and professional experience and are expressed as of the date of its release. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is intended to speak to any future periods. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties.

This does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product, nor does it constitute a recommendation to invest in any particular security. An investment in securities is speculative and involves a high degree of risk and could result in the loss of all or a substantial portion of the amount invested. There can be no assurance that the strategy described herein will meet its objectives generally or avoid losses. Essex makes no warranty or representation, expressed or implied; nor does Essex accept any liability, with respect to the information and data set forth herein, and Essex specifically disclaims any duty to update any of the information and data contained in the commentary. This information and data does not constitute legal, tax, account, investment or other professional advice. Essex being registered by the SEC does not imply a certain level of skill or training.

Please find important disclosures here.