Essex Global Environmental Opportunities Strategy (GEOS) August 2023 Update

Equity market volatility was dampened in July 2023, the result of Wall Street vacations and an investor redirection toward an economic soft landing versus the prior consensus for a recession. As we have been communicating the past year, this period is unlike most in history, as the pandemic and its resulting fiscal and monetary responses caused massive labor and economic productivity dislocations which the global economy is still absorbing. While we don’t believe we have any differentiated prowess regarding economic forecasting, we do know:

-there is still a skilled and un-skilled labor shortage

-onshoring announcements will increase

-commodity price volatility should continue

-electrical grid infrastructure investments must increase

-inventory management for manufacturing is increasingly complex

-shipping finished goods is expensive given labor shortages

We could go on with many more points amidst this opaque economic climate and believe our thesis of investing in the equity shares of companies that enable economic growth with fewer resources is well positioned for long term benefit now more than ever.

We speak to the impact of GEOS as providing cleaner solutions for our economy, or “doing more with less.” The other major point of differentiation for GEOS is enabling companies to meet their sustainability initiatives. In June alone, corporations reported 18 power purchase agreements (PPAs), totaling 2.3 gigawatts according to Bloomberg New Energy Finance (BNEF). The bulk of these PPAs are based in the US, with a current running total for 2023 standing at 13.6 gigawatts. The US however is still running behind Europe and China, but the race is on given the strong commitments exiting the Inflation Reduction Act.

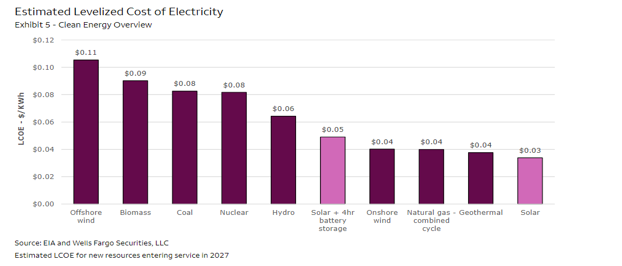

As we have written in the past, the world’s overall energy consumption is increasingly dominated by the non-OECD countries – energy demand peaked over fifteen years ago in developed economies, as measured by the Energy Institute’s Statistical Review of World Energy. The world’s energy consumption doubled last year versus 1985, four times the levels of the early 1960s. The good news is that cleaner renewables are taking share from fossil fuels, as solar and wind are now the cheapest forms of energy.

GEOS power technology holding Shoals Technologies just released their 2022 ESG report. Board of Directors independence, of which we have expressed past concerns, has improved to 100% in this latest report, versus 75% in 2021. 50% of all US-based solar projects installed last year used Shoals electricity balance of systems products. Shoals reports they solve for five UN Sustainable Development Goals (SDGs): 7 – Affordable and Clean Energy. 8 – Decent Work and Economic Growth, 9 – Industry, Innovation and Infrastructure, 11- Sustainable Cities and Communities, and 13 – Climate Action. For more information on the US SDGs, please refer to the GEOS impact whitepaper:

https://www.essexinvest.com/insights/high-impact-listed-equity-investing/

Additionally, we would be happy to meet and cover our approach to SDG solutions, using examples in our latest second quarter 2023 presentation deck.

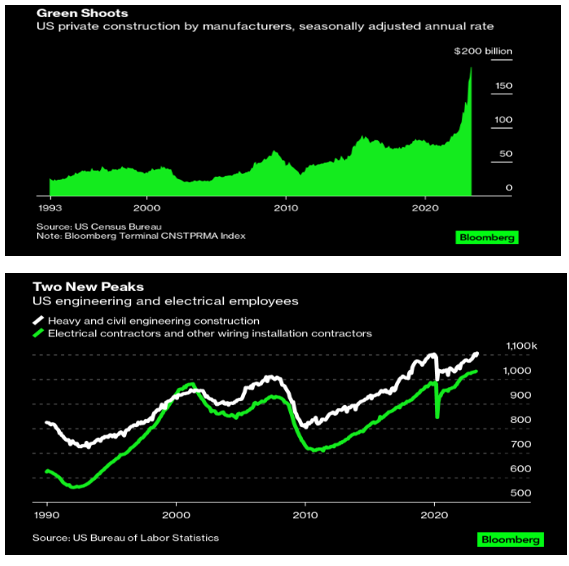

While investors wrestle with the prospects of an economic recession, many segments of our domestic economy are booming. For example, commercial construction spending has reached over $190 billion this year, double the rate of 2022 according to the US Census Bureau (see next page chart). Most of the construction is for battery plants, for stationary storage and EVs, as well as semiconductor fabrication plants. While these developments are partially driven by incentives such as last year’s Chips Act and the Inflation Reduction Act, the announcements are also due to the new reality – companies are seeking inputs, from chips to batteries, close to home. Civil engineering has rebounded from a pre-pandemic low, and general and electrical engineering are in record employment territory (second chart on next page). This factory boom is also due to the new reality of onshoring, to lessen the business risks experienced during the pandemic and past cycles, relying on supplies that took months to arrive at port.

GEOS has exposure to technologies that will enhance and benefit from this trend, from factory robotics to energy efficiency systems for warehouses, and distributed power systems to power facilities with no grid connection. Many industrial sites and manufacturing facilities are experiencing construction delays for months, given the lengthy permitting process for electrical grid connections. Data centers are experiencing expansion hurdles given electric utility grid limitations. GEOS has extensive exposure to technologies that

allow for more rapid construction development, using renewable energy arrays and hydrogen fuel cells. These technologies can power facilities with power provided at the site. Distributed water management is also a key and growing solution. Here, energy recovery technology harvests fluid flow in facilities to lower energy use and provide clean water as a result. The new rise of American manufacturing is occurring with an embrace of many of the GEOS themes – another strong catalyst and driver for clean tech and resource efficiency.

Disclosures:

This commentary is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. The opinions and analyses expressed in this commentary are based on Essex Investment Management LLC’s (“Essex”) research and professional experience and are expressed as of the date of its release. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is intended to speak to any future periods. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties.

This does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product, nor does it constitute a recommendation to invest in any particular security. An investment in securities is speculative and involves a high degree of risk and could result in the loss of all or a substantial portion of the amount invested. There can be no assurance that the strategy described herein will meet its objectives generally or avoid losses. Essex makes no warranty or representation, expressed or implied; nor does Essex accept any liability, with respect to the information and data set forth herein, and Essex specifically disclaims any duty to update any of the information and data contained in the commentary. This information and data does not constitute legal, tax, account, investment or other professional advice. Essex being registered by the SEC does not imply a certain level of skill or training.

Please find important disclosures here