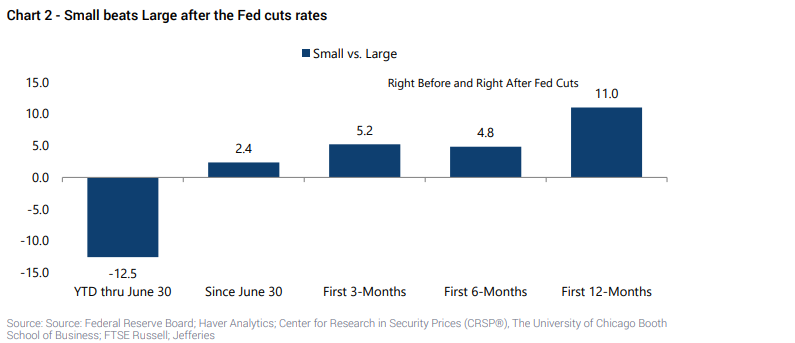

Fed Rate Cuts Often Ignite Small-Cap Outperformance

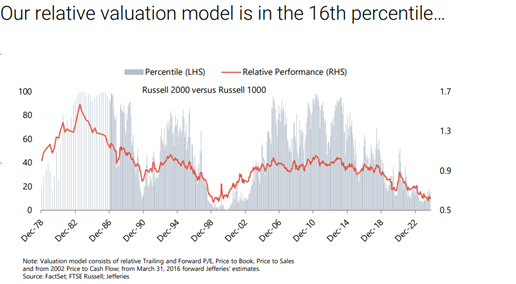

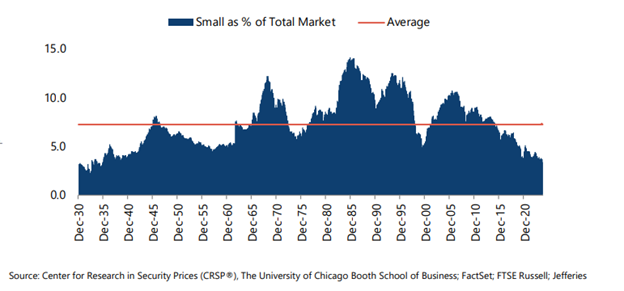

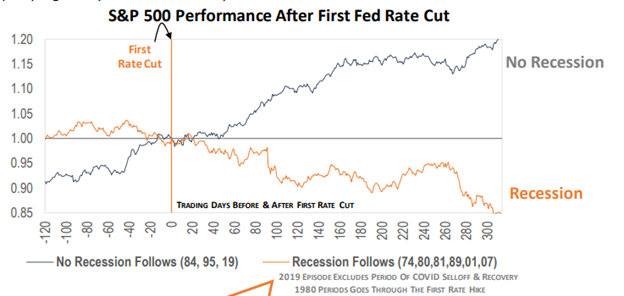

Fed rate cuts have often acted as a catalyst for small-cap outperformance, with this segment frequently outperforming large-caps over the next 3, 6, and 12 months. Coupled with cheap valuations, accelerating M&A activity, and improving earnings, we are optimistic that the recent trend of small-caps outperforming large-caps can continue. Additionally, tight high-yield spreads and a steeper yield curve further support this outlook.

- Risk Appetite: Lower interest rates generally reduce borrowing costs and can stimulate economic growth, boosting investor confidence and increasing risk appetite. Currently, small-cap stocks are historically under-owned and undervalued. As risk appetite improves and the discount for small-cap stocks narrows, this should drive a reversion to the mean in terms of both performance and positioning

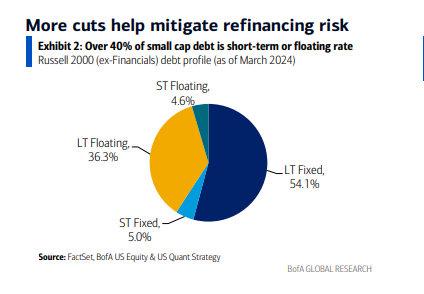

- Liquidity and Access to Capital: Lower interest rates improve market liquidity and make it easier for smaller companies to access capital. As small-cap firms rely more heavily on external financing compared to larger companies, this can lead to improved performance. The small-cap sector has been particularly sensitive to refinancing risk during the Fed’s rate-hiking cycle, and we expect this risk to diminish significantly during the easing cycle.

3. Cyclical Sensitivity: During Fed easing cycles where employment deteriorates sharply (e.g., during a recession), market selloffs often occur as unemployment claims rise. Small-cap stocks, being more sensitive to economic cycles, tend to experience more pronounced performance differentials under these conditions.

In summary, small-cap stocks historically perform well following Fed rate cuts, especially when the cuts are aimed at stimulating economic growth. We see no reason to believe this time will be different.

Please find important disclosures here